Long-awaited Port of Santos auctions to be held in 2023 only

Jul, 25, 2022 Posted by Gabriel MalheirosWeek 202230

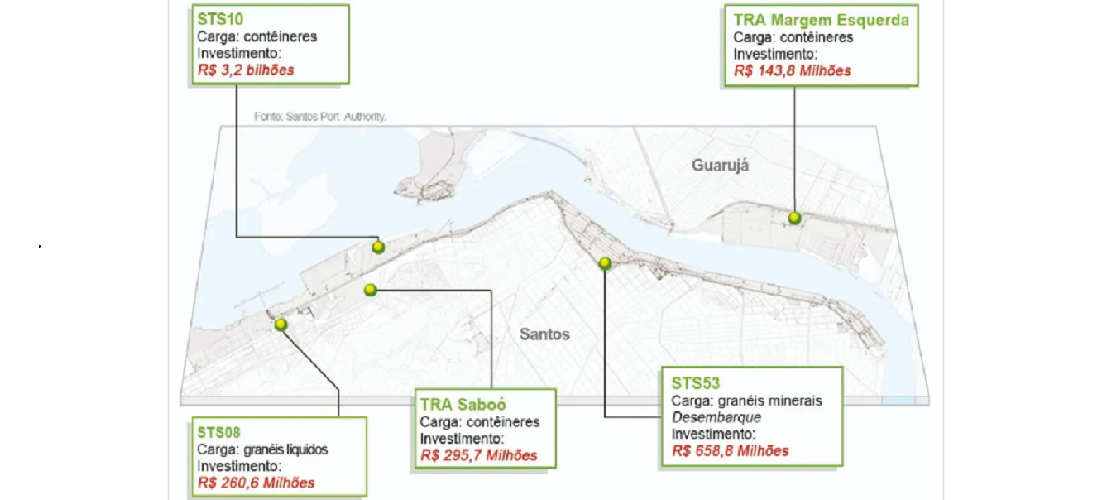

Most auctions initially scheduled for this year at the Port of Santos will be held only in 2023. This information was disclosed by Brazil’s Ministry of Infrastructure (Minfra), which foresees – for the next year – the concessions of STS10 (mega container terminal), STS08 (liquid bulk and fuels), and two Customs Bonded Dockside Terminals. Still, the government agency states that at least the public notices on these privatization processes will be ready in the second half of 2022.

In March, the Santos Port Authority, the organization responsible for managing the Santos port complex, informed the newspaper A Tribuna that six terminal auctions would be held in 2022. However, out of this total, only one project got off the ground (STS11), and another (STS53) is scheduled to happen by December. The other four had to be rescheduled by Minfra for the first quarter of next year.

STS53, located in a region known as Outeirinhos, near the port’s right bank, has an area of 87,900m². The Federal Ministry informs that the final concession draft is under review as the public consultation process ended June 30th. In a formal note, the National Waterway Transportation Agency (Agency) said it analyzed and responded to the contributions received by the public. The terminal will handle and store solid mineral bulk, especially fertilizers and sulfates, with an estimated investment of BRL 658.8 million and an expected annual throughput of 89.8 million tonnes.

The project, however, causes controversy in the port sector. This is because, in a public hearing at the end of June, representatives of Concais – the company that manages the Giusfredo Santini Maritime Passenger Terminal, dedicated to maritime cruises in the Port of Santos – argued in favor of suspending the bidding procedures of STS53 until the Federal Government is able to transfer the passenger terminals to the Valongo region.

On the other hand, SPA stated that STS53 is key to safeguarding the “flow of Brazilian agribusiness products at competitive costs.” The Port Authority also explained that the year-on-year growth of fertilizer imports through the Port of Santos has remained in double digits since 2016. In fact, “it is not greater because Santos lacks the specialized capacity to receive fertilizer cargoes heading to the most important region in this market: the Brazilian Center-West.”

According to SPA, Santos utilizes only 15% of the return freight potential created by the agribusiness exports route, “while the indicator for Paranaguá (PR), currently the leader in fertilizer landings, is 56%, despite Santos being the shortest route and with the best cost for the producer and consumer.”

Nest year

In the package of upcoming auctions, the mega container terminal STS10 was surrounded by most expectations as it had the highest investment forecast. However, its bidding process will only come to an end in the first quarter of 2023. With a total area of 601 thousand m² in Saboó, the terminal will have a capacity of at least 1.9 million TEU/year, with investments of BRL 3.2 billion. Having gone through a public consultation process in May, the project is being reviewed by Minfra, which is expected to publish the public auction notice in the last quarter of 2022.

The Port Authority stated that the terminal is crucial for the growth of the Port of Santos. “Containerized cargo throughput has been growing at double digits and has already reached almost the current capacity of the port complex,” reports SPA.

SPA recalls that the capacity of the port of Santos for this type of operation is 5.3 million TEU, and in 2021, the container throughput reached 4.8 million. “If the port maintains this pace in the coming years, the existing capacity will not be enough. Thus, there is a pressing need to expand capacity to meet the demand created by the flow of containers.”

In turn, the STS08 was up for auction in November last year but did not receive a bid. In response, MInfra listened to market agents and potentially interested parties and is now reviewing the concession model for the terminal destined for liquid bulk (fuel), with 168.3 thousand m², in the Alemoa region.

Approximately BRL 260.6 million are expected as investments. The project will be re-submitted to the Federal Court of Accounts (TCU – Brazil) to gain authorization to re-issue a public notice. Minfra expects the auction to take place in the first quarter of 2023.

Bonded Terminals

According to Minfra, the designs of the two Customs Bonded Dockside Terminals (Left Bank and Saboó) are still being developed. They are currently being assessed in terms of technical feasibility and economic and financial viability. The ministry is evaluating the best lease format for these terminals and predicts that the auctions will take place in the first three months of 2023. With estimated investments of R$ 143.8 million, the Left Bank Bonded Terminal will handle general containerized cargo in its 85,000-strong area. m². In the meantime, the bonded terminal in Saboó will also take the same type of cargo in an area of 175,300 m². The estimated investment for this terminal is R$ 295.7 million.

The STS11, designed for receiving, storing, and transporting solid vegetable bulk, was sold on March 30th for R$ 10 million to Cofco International Brasil. The Port Authority informed that the payment was divided into parts: 25% of the amount upon approval of the result and five annual installments. Furthermore, the lessee will pay R$ 3.7 million per month as a fixed lease (for area exploration) and R$ 5.63 per ton as a variable lease.

Located in Paquetá, on the Right Bank of the port complex, the area will feature 61,900 m² in its first development phase, and, from the second phase onwards, it will have 98,100 m², with two exclusive berths. The planned investments are R$ 764.8 million, and the terminal’s annual handling capacity will be 14.3 million tonnes.

According to the Port Authority, the list of 11 auctions modeled since 2019 – six already carried out – adds up to BRL 7.1 billion in investments and collaborates with increasing capacity “for the Port of Santos to meet the cargo demands projected in the Plan of Development and Zoning (PDZ) 2020-2040, which points to a 50% growth in cargo handling, reaching 240 million tonnes/year”.

However, investment values may change until the notices are published by Antaq with the auction date set, as they are constantly updated.

Source: A Tribuna

To read the full original article, please go to: https://www.atribuna.com.br/noticias/portomar/quatro-leiloes-previstos-para-este-ano-no-porto-de-santos-ocorrerao-em-2023

-

Ports and Terminals

Jan, 19, 2021

0

39 million tons handled at Rio Grande do Sul ports in 2020

-

Ports and Terminals

Dec, 03, 2020

0

Docas do Rio installs vídeo cameras at Rio-Niterói bridge

-

Ports and Terminals

Jul, 13, 2022

0

Antaq demands adjustment on Port of Itaqui new fuel terminal report

-

Coffee

Jul, 26, 2021

0

Brazil estimates that frost has damaged up to 11% of the Arabica coffee area