CLI evaluates possible capacity expansion at Tegram terminal

Apr, 29, 2021 Posted by andrew_lorimerWeek 202118

The continuous increase in volumes handled by CGG Trading’s grain terminal at the Port of Itaqui, in Maranhão, led Corredor Logística e Infraestrutura (CLI), the unit’s operator, to begin considering the possibility of expanding the site’s capacity.

Dados da Datamar mostram que o número de escalas vem crescendo ano após ano e que a principal mercadoria movimentada é a soja seguida do milho e celulose.

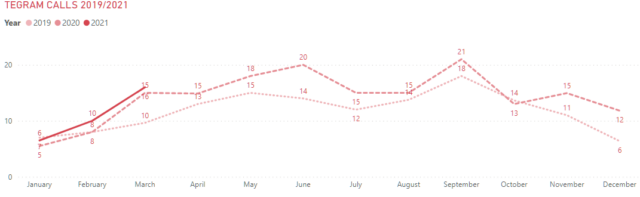

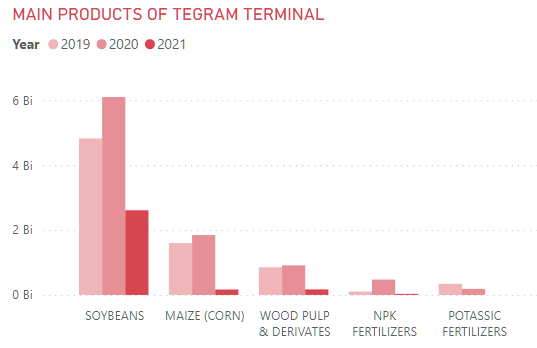

Datamar data shows that the number of vessel calls at the terminal has been growing year after year and that the main commodity moved through the port is soybeans followed by corn and wood pulp.

Acquired by the administrator IG4 Capital at the end of last year, CLI, headquartered in São Paulo, is one of the four companies that make up the Tegram Consortium responsible for grain operations in Itaqui. The other companies are Glencore, Terminal Corredor Norte – linked to the trading company NovaAgri – and ALZ Terminais Portuárias, controlled by Amaggi, Louis Dreyfus

After Tegram’s second phase was inaugurated in early September last year, its total capacity increased to 15 million tons per year. Approximately R$ 230 million was invested in this phase to duplicate the railway hopper and belts.

“At the mouth of the ‘Mapito’ funnel [confluence between the states of Maranhão, Piauí, and Tocantins], Tegram is a success. As the goals of the first phase were reached early and those of the second phase are also going very well, we have already started studies for a new expansion”, said Helcio Tokeshi, director and partner of IG4, to Valor.

In 2020, almost 8 million tons of grain were exported through the terminal, and the volume is expected to reach 10 million tons this year. Most of the cargo is soy, but the flow of corn is also increasing.

If this new expansion is done by installing a third berth with a ship loader, there will probably be room for another 7.5 million tons, with investments similar to those of the second phase. But this is just one of the alternatives under analysis, and a final decision will also depend on negotiations with the other Tegram partners.

The only Tegram partner not linked to trading companies, CLI has taken advantage of its status as a “white flag” to attract traders of grains that are “light in assets,” according to Tokeshi. The company’s innovation agenda is also full, with ongoing approximations with AgTechs and LogTechs, said the executive.

Excited about the CLI results, the IG4 Capital manager intensified the prospects for investing in port terminals, according to Tokeshi.

-

Trade Regulations

Aug, 25, 2022

0

Brazil changes drawback rules to streamline vessel exports

-

Economy

Dec, 08, 2022

0

Chinese exports fall at steepest pace in more than two years

-

Ports and Terminals

Feb, 01, 2022

0

Antaq evaluates the Transnordestina railway project worth R$2.35 billion at Pecém

-

Other Logistics

Jul, 20, 2022

0

Suzano closes USD 120M deal to lease rail wagons for five years