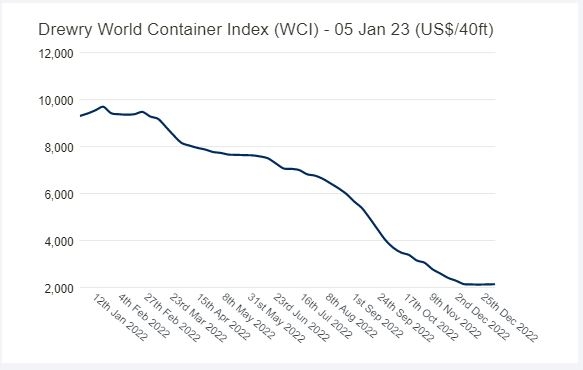

Container spot rates end 43-week falling streak

Jan, 12, 2023 Posted by Gabriel MalheirosWeek 202302

The Drewry’s World Container Index finally shot green in its first-ever quote for 2023, ending at US$2,135, recording an appreciation of 0.7%, after having trodden the red territory since February 2022.

The index was primarily fuelled by the China-Rotterdam trade lane rates which appreciated by 10%, after having breached the pre-pandemic levels on the downside. The Shanghai-Genoa rates are supported with an upside of 2%. While rates on the other trade lanes were subdued, the transatlantic trade witnessed rates inching downwards by 6% on the Rotterdam- New York route.

While the street expects rates to be on a downtrend till Mid-2023, with bulk of the fall coming around the Chinese New Year, inflation in Europe and interest rates in the US could be key drivers in dictating trade.

The Global Supply Chain Pressure Index (GCSPI) has bounced off its September lows to record 1.20 for November 2022, impacted primarily by Chinese Delivery times. The relaxation in Zero-Covid policy in China could be a fillip towards shifting action on trade.

The Shanghai Containerized Freight Index (SCFI) had broken its fall streak, since the Chinese New Year 2022, during the last recorded quote for 2022, while the Freightos Global Index (FBX) had recorded an appreciation of over 6% in its latest weekly quotes, suggesting there has been some immediate cushioning.

It must also be noted that the cancellation of sailings had been a record high (17%) as against the average of 12-13% witnessed over the past few weeks. This could have aided in cushioning some of the falls.

Source: Container-News

To read the full original article, please access: https://container-news.com/container-spot-rates-end-43-week-falling-streak/

-

Ports and Terminals

Aug, 06, 2020

0

Port of Rio conducts fourth experimental nocturnal maneuver at Canal de Cotunduba

-

Grains

Nov, 03, 2023

0

US Soybean Exports Drop 27% While Brazil Achieves Record High

-

Meat

May, 20, 2022

0

China accounts for half of Brazil’s beef exports

-

Trade Regulations

Aug, 15, 2022

0

Ukrainian grain headed for Africa